Most 7- and 8-figure Amazon brands don’t have a keyword problem; they have an intent and conversion system failure. This guide shows you what actually drives rank, margin, and incrementality.

You’ve generated thousands of Amazon search keywords. Titles are optimized. Backend fields are full. Yet organic rank is flat, and TACoS isn’t moving. The problem isn’t keyword volume — it’s intent alignment and conversion momentum. Most brands optimize for indexing, not impact. Keywords don’t drive sales; buyer intent does. With Amazon’s AI models like Rufus and Cosmo prioritizing intent over keyword density, relevance now depends on conversion behavior, not word count. If keywords aren’t mapped to buyer intent, Amazon may index your listing, but shoppers won’t convert.

This guide is for multi-SKU brands managing 250+ ASINs that are stuck in flat organic growth despite ongoing SEO and PPC investment.

At-a-Glance: Why Your Keyword Strategy Is Broken

Table of Contents

| Concept | The Bottom Line |

|---|---|

| What Amazon search keywords do | They help Amazon’s algorithm understand your product’s relevance for indexing. That’s it. |

| Why keyword generation fails | A list of keywords without context ignores buyer intent, competition, and conversion potential. |

| Indexing vs. Ranking | Indexing gets your product into the search pool. Ranking is earned through performance (clicks and sales). |

| The growth bottleneck | When you manage a large catalog, a manual, per-listing keyword approach creates chaos and cannibalization. |

What Amazon Search Keywords Really Do (And Don’t)

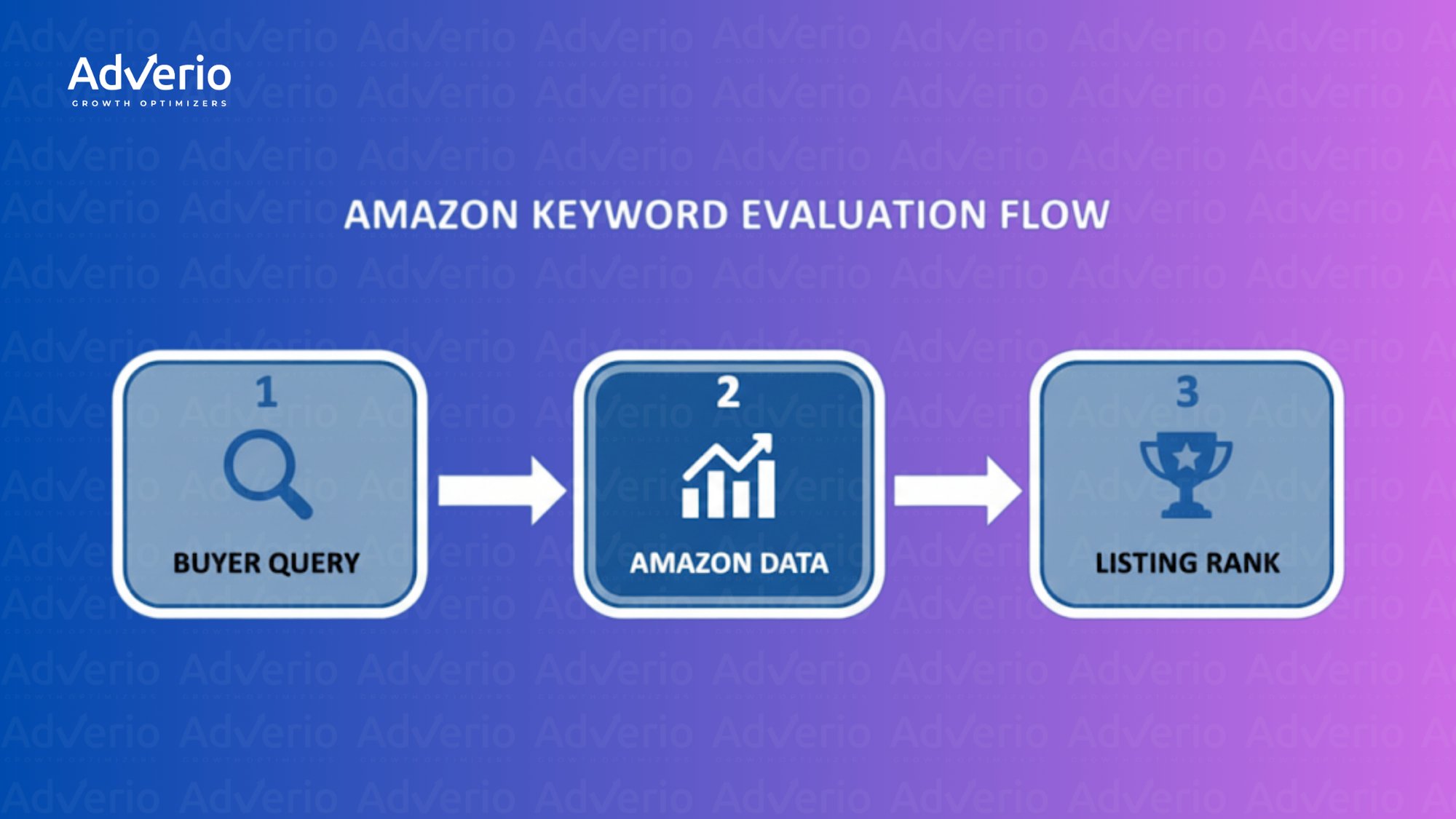

Keywords do one thing: they make you eligible. They do not make you profitable. They are the data points that help Amazon understand what your product is and which customer queries it might answer. This initial step is called indexing. When your product is indexed for “waterproof hiking boots,” it becomes eligible to appear in search results for that query.

Indexing is permission to compete. It’s not performance. This is where most brands stumble. They confuse being seen by the algorithm with being chosen by the shopper.

Indexing gets you seen. Conversion gets you paid.

Jamming your listing with every possible keyword variation might get you indexed for thousands of terms, but it doesn’t guarantee a single click, conversion, or dollar in profit. In fact, if your product gets indexed for irrelevant terms and fails to convert, you’re sending negative signals to Amazon that can actively harm your rank over time.

If your growth plan starts and ends with keyword volume, you’re optimizing activity — not outcomes. They do not guarantee:

-

Clicks: Your listing appears, but a weak main image or non-competitive price makes shoppers scroll right past.

-

Conversions: The shopper clicks, but your bullet points are unconvincing and your A+ Content fails to close the deal.

-

Profit: You rank for a broad, high-volume term that attracts low-intent traffic, leading to a sky-high ACoS and dismal profitability.

The goal isn’t just to generate SEO keywords for Amazon; it’s to build a system where keywords are the first input in a conversion-focused machine.

Why “Generate SEO Keywords for Amazon” Is the Wrong Question

If your team’s primary task is to simply “generate SEO keywords for Amazon,” you are asking the wrong question. This outdated approach treats keywords as an output, a deliverable to check off a list. The real question isn’t about how many keywords you can find; it’s about what shoppers intend to do when they type a query.

Chasing bigger keyword lists is a relic of old-school SEO that Amazon’s algorithm outgrew years ago. The modern marketplace demands a shift from keyword collection to intent translation.

Keyword Lists ≠ Keyword Strategy

A static keyword list is useless because it lacks context. It’s a collection of words stripped of the three elements that actually matter on Amazon: the buyer’s mindset, the competitive landscape, and the conversion potential.

Here’s why a list-based approach is fundamentally broken:

-

It ignores buyer stage: A shopper searching “running shoes” is browsing. A shopper searching “men’s trail running shoes size 11” is buying. A keyword list treats both equally, but their value is worlds apart.

-

It ignores SERP context: The keyword “yoga mat” might have huge volume, but if the top spots are locked down by brands with 10,000+ reviews, targeting it is a waste of resources.

-

It ignores CVR impact: Stuffing your listing might get you indexed, but if the terms don’t align with your product’s features, your conversion rate will plummet, telling Amazon your listing is a poor match.

Where Most Brands Break Keyword Strategy

This flawed “more is more” approach inevitably leads to outdated tactics that Amazon now actively penalizes. The same mistakes appear again and again:

-

Overstuffed Titles: Jamming every keyword permutation into a title creates a spammy, unreadable mess that repels human shoppers.

-

Backend Keyword Dumping: Using backend search term fields as a dumping ground for irrelevant or competitor terms confuses the algorithm and dilutes your relevance. For more on the right way, see our guide to a powerful Amazon backend search term optimization strategy.

-

Ignoring Search Query Performance Data: Relying on third-party tools while ignoring the ground-truth data in Amazon’s own reports is just guessing.

If you add keywords without improving CTR or CVR, rank stalls—even when indexing improves.

This is the critical failure point. Amazon rewards listings that solve a shopper’s problem, not listings that simply mention a keyword.

How Amazon Actually Evaluates Keywords in 2026

If you still think Amazon is a keyword-matching engine, you’re playing a 2018 game in a 2026 marketplace. Today’s algorithm—powered by sophisticated AI like Rufus and Cosmo—is a ruthless conversion and satisfaction engine. It doesn’t ask, “Does this listing mention the keyword?” It asks, “Does this listing satisfy the buyer who typed this query?”

Amazon’s evaluation model is a dynamic feedback loop, not a static checklist. It constantly analyzes real-world buyer behavior to determine which products earn top placement.

The algorithm leans heavily on these performance signals:

-

Search Query Performance (CTR, CVR signals): Amazon’s own data shows exactly how shoppers interact with your product for specific queries. A high click-through rate (CTR) and conversion rate (CVR) are direct proof of relevance.

-

Buyer Behavior Feedback Loops: Every click, add-to-cart, and bounce is a vote. A quick search-click-buy sequence sends a powerful positive signal. A click followed by an immediate exit tells the algorithm your listing was a dead end.

-

Rufus / Cosmo Alignment: Amazon’s new AI models are designed to understand context and intent far beyond simple keyword matching, favoring products that truly answer the underlying need behind a query.

-

Historical Performance Weighting: Amazon has a long memory. A product’s consistent, long-term success for a query builds authority, creating a flywheel effect that is difficult for new competitors to break.

The Incrementality Problem Most Brands Ignore

Many brands think their keyword strategy works because branded terms convert. But branded search is demand capture — not demand creation. Real growth comes from structured Amazon PPC management for incremental growth, not just harvesting existing demand.

-

Shift investment toward generic and competitor terms

-

Track impression → click → add-to-cart → purchase share

-

Separate efficiency from incrementality

From Keywords to Queries to Buyers (The Missing Layer)

Winning on Amazon means engineering your listings and ads to satisfy a specific buyer intent cohort, better than anyone else on page one. The game hinges on a critical distinction: the difference between a raw search term (what a shopper types) and the buyer intent (what they really want).

Search Terms vs Buyer Intent

Failing to distinguish between query types is like trying to sell a premium steak to a vegetarian. You must learn to classify queries based on their purpose:

-

Informational Queries: “How to clean leather boots” (research phase)

-

Transactional Queries: “men’s waterproof leather boots size 11” (ready to buy)

Amazon’s algorithm is engineered to reward listings that perfectly match the intent behind the search. This is why a detailed product page will outrank a generic one for a hyper-specific, long-tail query.

Why Query Mapping Beats Keyword Density

This leads to query mapping: the strategic process of optimizing specific listings to convert distinct groups of queries. It’s the polar opposite of keyword stuffing. Instead of building one giant list, you map specific queries to specific conversion goals, treating your listings as surgical tools, not blunt instruments.

The approach forces you to think in cohorts. One listing is optimized to capture the broad “waterproof boot” crowd, while a variation is meticulously engineered to convert the “vegan leather winter boot” segment.

Amazon rewards listings that convert for a query—not listings that mention it.

Your click-through and conversion rates are the hard data that prove your relevance. Without strong performance, your keywords are just noise. For more on this, explore our guide to mastering your Amazon Listing Quality Score (LQS) framework

Why This Breaks at Scale (Large Catalog Reality)

A manual, per-listing approach to keywords might work for a dozen products. For 7- and 8-figure brands with large catalogs, it’s a guaranteed growth bottleneck. At scale, the tactic of “optimizing one more listing” becomes a liability, as your once-meticulous strategy begins to work against you.

This is where most brands need structured Amazon catalog optimization services, not another spreadsheet.

Keyword Chaos in Large Catalogs

With hundreds or thousands of SKUs, the risk of your own listings competing against each other skyrockets. This is where high-growth brands slam into a wall.

-

Cannibalization: Multiple products target the same high-intent queries, diluting rank and sales velocity across all of them instead of creating one dominant winner.

-

Duplicate Intent: Similar long-tail keywords are assigned across different SKUs, sending mixed signals to Amazon about which product is the best answer for a query.

-

Indexing without Rank Lift: Your effort is spread too thin. Hundreds of SKUs get indexed for thousands of terms, but no single product accumulates enough sales velocity on a core query to build ranking momentum.

Why Manual Keyword Work Doesn’t Scale

The core problem is that manual optimization is a linear solution to an exponential problem. A per-listing vendor can’t see the full picture of catalog-wide cannibalization. You cannot manually optimize your way out of a system-level problem.

Brands invest more in headcount or agency retainers, only to see diminishing returns. The reality is that your “keyword problem” is a systemic issue rooted in a lack of a unified, catalog-wide conversion strategy. Understanding the financial impact of each product is crucial, which is why brands need to be utilizing SKU economics on Amazon to make smarter, data-driven decisions.

What a Real Amazon Keyword System Looks Like

Fixating on how to generate SEO keywords for Amazon is a sign of a deeper strategic gap. Winning at scale requires moving from messy spreadsheets to an intelligent system. A true keyword system isn’t a list; it’s a continuous, data-driven process.

A real system incorporates:

-

Query Intelligence: Continuously harvesting and analyzing real-world search query performance data—not just third-party estimates.

-

Intent Classification: Systematically categorizing queries (informational, transactional, branded) to map the right products to the right buyers.

-

CTR & CVR Benchmarking: Establishing performance baselines for your most critical queries to identify optimization opportunities and threats.

-

Continuous Iteration: Treating keyword optimization as a dynamic feedback loop, where performance data informs ongoing adjustments to listings, ads, and content.

This is about building a machine that translates visibility into profit, not just a longer list of terms.

How Adverio Turns Search Visibility Into Market Share

Most agencies optimize listings. We govern growth systems.

Adverio aligns:

-

Profit-driven catalog optimization

-

High-incrementality PPC structures

-

Conversion-focused listing architecture

-

Market share funnel diagnostics

If your keyword strategy isn’t translating into incremental revenue, the issue isn’t SEO — it’s system misalignment.

FAQs

What are Amazon search keywords?

Amazon search keywords are the words and phrases in your product listing (title, bullets, backend) that tell Amazon’s algorithm what your product is. Their sole job is to get your product indexed, making it eligible to appear in relevant search results. They are the starting point for visibility, not a guarantee of sales.

How do I generate SEO keywords for Amazon?

The best way to generate SEO keywords for Amazon is to analyze your own Search Query Performance data to find the exact terms that already drive clicks and sales. Supplement this with competitor analysis and tools to identify new opportunities. The goal is not to create a massive list, but to identify high-intent queries that you can convert profitably.

Why aren’t my keywords improving rank?

Your keywords aren’t improving rank because rank is driven by performance, not keyword density. You can be indexed for a term, but if shoppers don’t click (low CTR) or buy (low CVR), Amazon’s algorithm learns your product is a poor match for that query and will suppress its rank. Rank follows conversion.

What’s the difference between search terms and keywords?

A search term is the exact phrase a shopper types into the Amazon search bar. A keyword is the target phrase you place in your listing to match that shopper’s intent. The most successful brands obsessively align their keywords with the most profitable real-world search terms.

How often should Amazon keywords be updated?

Update your keywords when the data tells you to, not on a fixed schedule. Continuously monitor your Search Query Performance report and organic rank. If a keyword isn’t driving clicks or sales, re-evaluate it. Major market shifts, new competitor launches, or seasonal trends are also immediate triggers for a keyword strategy review.