A profit-first breakdown of every Amazon FBA fee in 2026—plus the strategic levers 7-figure brands use to protect margin and scale without bleeding cash.

An Amazon FBA fee breakdown is not an accounting exercise. It’s a margin protection strategy. For 7- and 8-figure Amazon brands managing hundreds of SKUs, every misplaced inch of packaging, every aged unit, and every misplaced dollar of ad spend compounds into six-figure losses.

Why Understanding Amazon FBA Fees Is More Critical Than Ever

Table of Contents

Here’s the hard truth: you can’t out-sell bad unit economics. Rising fulfillment, storage, and return costs have turned operational efficiency into your primary profit lever. The 2025 fee hikes aren’t going away—and 2026 adds new pressure for low-margin SKUs. Proactive fee management is no longer optional.

Most brands fall into Optimization Myopia—over-fixating on ACoS while ignoring inventory penalties, placement fees, and margin erosion at the SKU level. A holistic view is the only way to win. It’s time to look past ad spend and get a grip on every cost that’s eating your lunch.

Full Amazon FBA Fee Breakdown for 2026

You can’t afford to treat FBA fees as a single line item. They’re a complex ecosystem of costs that can either fuel your growth or silently bleed you dry. This breakdown demystifies every major fee, giving you the clarity to plug leaks and protect your margins.

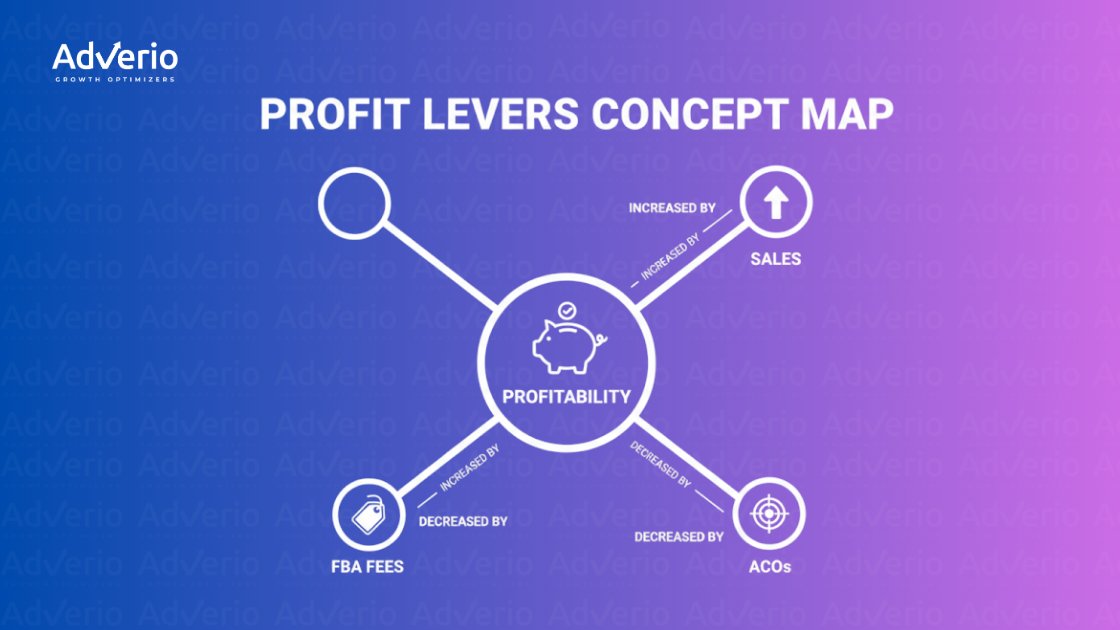

Think of your profitability as a three-legged stool: sales volume, ad performance (ACoS), and FBA fees. Kick one leg out, and the whole thing crashes.

This visual makes it painfully clear: driving sales and optimizing ads are mission-critical, but if you’re not actively controlling your FBA fees, you’re leaving a massive hole in your profitability strategy.

1) Fulfillment Fees

This is what you pay Amazon to pick, pack, and ship your products. It’s not a flat rate; it’s a dynamic cost based on your product’s size tier (from small standard to large oversized) and shipping weight.

- What it is: A per-unit fee for handling and delivery.

- 2026 Rate: Tier-based, with rates carried over from 2025’s structure. Apparel continues to carry an extra surcharge per unit.

- How to Mitigate: Packaging optimization. Shaving even a fraction of an inch off your product’s dimensions could drop it into a lower, cheaper size tier, saving you money on every single sale.

2) Referral Fees

This is Amazon’s commission for access to their massive customer base. For every sale, Amazon takes a percentage of the total price, including the item price and shipping.

- What it is: A commission on every sale, typically between 8% and 15%.

- 2026 Rate: Varies by category. Home & Kitchen is ~15%, while consumer electronics is closer to 8%.

- How to Mitigate: Avoid the blended margin trap. Analyze the fee’s impact on a per-ASIN basis, not as a general average. An 8% fee on a high-volume SKU can generate more absolute profit than a 15% fee on a slow-mover. Factor this into your product and pricing strategy.

3) Monthly Storage Fees

Amazon charges you for every cubic foot your inventory occupies in their fulfillment centers. This fee isn’t static; it changes based on the product’s size tier and time of year.

- What it is: A fee for space your products take up in Amazon warehouses.

- 2026 Rate: Standard-size storage fees can triple to $2.40 per cubic foot during the Q4 peak season (October-December).

- How to Mitigate: Maintain a high inventory sell-through rate. These fees become a serious threat to products that are bulky but don’t sell quickly. You can learn more about the detailed breakdown of these escalating costs on AMZ Prep.

4) Aged Inventory Surcharge (Long-Term Storage Fees)

Amazon’s fulfillment centers are not your personal long-term warehouses. The Aged Inventory Surcharge is a penalty imposed on sellers for allowing stock to sit idle.

- What it is: A penalty fee for inventory stored for more than 181 days.

- 2026 Rate: The fees escalate dramatically as inventory ages past 271 days and beyond.

- How to Mitigate: Proactive portfolio management. Regularly monitor inventory age in Seller Central and have a plan to liquidate or remove slow-moving stock well before it hits the 181-day threshold.

5) Removal, Disposal, and Returns Processing Fees (2026)

Getting unsold inventory out of an FBA warehouse isn’t free. Whether you have it shipped back to you (Removal Order) or ask Amazon to get rid of it (Disposal Order), you pay a per-item fee.

- What it is: A collection of fees for removing old stock and handling customer returns.

- 2026 Rate: The Returns Processing Fee, carried over from mid-2025, applies to items with high return rates (excluding apparel/shoes).

- How to Mitigate: Reduce your return rates. Improve product listings with painfully accurate details, high-quality images, and clear instructions. Monitor customer feedback and returns reports to spot recurring issues, then fix them at the source.

FBA Fee Changes from 2025 to 2026 — What’s New?

Trying to keep up with Amazon’s fees feels like chasing a moving target. The changes rolled out last year aren’t just minor adjustments; they’re a fundamental shift penalizing any hint of operational inefficiency. Let’s break down what’s still impacting your margins in 2026.

Inbound Placement Service Fee

Introduced in 2025 and still a headache in 2026, the Inbound Placement Service Fee is what you pay for the convenience of sending all your inventory to a single fulfillment center (FC).

- What it is: A fee for Amazon distributing your inventory across its network.

- 2026 Rate: For a standard-sized product, this fee ranges from $0.21 to $0.68 per unit.

- How to Mitigate: Run the numbers. For high-volume sellers, splitting shipments to multiple FCs might be cheaper than paying the per-unit placement fee. Calculate your breakeven point on a per-shipment basis.

Low Inventory Fee (Critical in 2026)

The Amazon Low Inventory Fee 2026 is easily one of the most disruptive changes. It’s a penalty for not keeping enough stock on hand.

- What it is: A fee applied if your inventory for a parent ASIN drops below 4 weeks (28 days) of supply relative to sales velocity.

- 2026 Rate: Varies based on size tier and how far below the 4-week threshold you fall.

- How to Mitigate: Maintain four to six weeks of inventory. In 2026, this is a high-stakes balancing act that demands precise forecasting and disciplined supply chain control. Use tools like SmartScout’s calculator to model the financial impact. This is where a disciplined Amazon inventory management strategy separates scaling brands from stagnant ones.

End of Small and Light → New Low-Price FBA Fees

The Small and Light program is gone, replaced by the new Low-Price FBA Fees. This happened in late 2025 and is fully enforced in 2026.

- What it is: A new, automated fee structure for items priced under $10.

- Who it affects: Sellers on the ground face a messier reality.

- Items <$10: If you were in Small and Light, you now pay about $0.30 more per item. If you weren’t, you pay less.

- Items $10–$12: This tier got hit hardest. These products used to qualify for Small and Light but are excluded from the new low-price rates, facing a major fee hike.

How to Calculate Amazon FBA Profit in 2026 (Per ASIN and Per Unit)

Vague P&L statements are where profitability goes to die. True control is won or lost at the individual ASIN level. Stop guessing and start calculating your actual per-unit profit with a framework that leaves no fee unturned.

This isn’t an accounting exercise. This is the blueprint for every strategic decision you make.

The Unit Economics Formula

Calculating your profit per unit is a ruthless process of subtraction. Start with your top-line revenue and deduct every cost associated with selling that one unit.

Let’s walk through it with a set of premium bedsheets selling for $75.00:

- Selling Price: $75.00

- Referral Fee: (15% for Home & Kitchen) -$11.25

- Fulfillment Fee: (Based on size/weight) -$8.50

- Storage Fee Allocation: (Assuming it sells in one month) -$0.45

- Inbound Placement Fee: (Standard size average) -$0.35

- Return Fee Allowance: (Based on a 5% return rate) -$1.00

- Advertising Cost (TACoS): Your ad spend is a direct cost of sale. If your Total Advertising Cost of Sales (TACoS) is 10%, that’s another -$7.50.

If you’re only optimizing for ACoS and ignoring total revenue impact, read our breakdown on reducing Amazon PPC ad spend the smart way.

After all costs, your true Profit After Ads is $45.95 per unit.

Now you have a crystal-clear, actionable number. You’ve moved from a fuzzy P&L to a granular understanding of what drives your business. To protect your bottom line, it’s not enough to just calculate profit; you also have to know how to calculate your break-even point, ensuring every sale puts money back in your pocket.

Tools to Help You Estimate & Optimize Fees

Guessing your FBA per unit cost is a recipe for disaster. To get a real grip on your numbers, you need to move from rough estimates to surgical precision. The right tech stack turns Amazon’s complex costs into actionable insights.

- Amazon FBA Revenue Calculator: Perfect for back-of-the-napkin math when vetting new product ideas. It’s a great starting point, but it doesn’t account for variable costs like advertising or inventory penalties.

- SKU Economics Tool: To scale profitably, you need a dedicated SKU economics Amazon tool or a third-party P&L dashboard. These platforms pull data from across Seller Central to give you a true, per-ASIN profitability analysis, bridging the gap between ad spend and unit economics. This is the only way to fine-tune your Amazon anchor pricing strategy.

- SmartScout Low Inventory Fee Calculator: Specialized tools are essential for tackling nuanced fees. SmartScout’s calculator helps you forecast the financial hit from stockouts, turning a confusing penalty into a predictable variable.

Real Strategies to Reduce FBA Fees in 2026 (Without Killing Sales)

Knowing the fees is one thing. Actively dismantling them is how you win. Let’s move from theory to execution with concrete strategies that attack the biggest profit drains in your business.

These are high-impact changes that deliver meaningful results across your entire catalog.

Optimize Packaging + Use SIPP

Your product’s packaging is a direct lever on your fulfillment costs. Smaller, lighter, uniform shapes fly through Amazon’s network more efficiently. For eligible products, the Ships in Product Packaging (SIPP) program is a game-changer. Certifying your product can ship in its own box earns you a fulfillment fee discount, typically ranging from $0.04 to $1.32 per unit, and speeds up delivery.

Maintain Healthy Inventory

In 2026, inventory management is a high-stakes balancing act. The sweet spot is maintaining four to six weeks of stock. This is your safe zone.

- Below four weeks: You risk the Low Inventory Fee.

- Above six weeks: You move closer to the Aged Inventory Surcharge.

This demands a disciplined approach to forecasting and highlights why sharp https://www.adverio.io/amazon-inventory-management/ is no longer optional.

Improve Return Rate

Returns are a direct hit to your bottom line. Actively managing this metric is non-negotiable.

- Analyze Returns Reports: Find out which ASINs are problems and why.

- Scrutinize Listings: Ensure your images and copy set painfully accurate expectations.

- Improve Product Quality: Use customer feedback as a free source of R&D.

Explore Fulfillment Alternatives

FBA isn’t always the most cost-effective solution, especially for heavy or bulky items hit hard by inbound placement fees. Exploring third-party logistics (3PL) providers is a smart move. While managing multiple partners adds complexity, the cost savings can be substantial. For a deeper dive, start by understanding third-party logistics for business storage and run a cost-benefit analysis against FBA for your problematic SKUs.

How Adverio Protects Margin Across FBA, Pricing & Ads

FBA fees don’t operate in a vacuum. They intersect with pricing, inventory depth, PDP conversion, and ad incrementality.

Through our Profit Pulse System and Growth Cultivator framework, we analyze SKU-level unit economics, isolate non-incremental ad spend, and reallocate budget toward higher-margin growth.

That means:

- Reducing branded demand capture waste

- Fixing catalog coverage gaps

- Aligning pricing with Buy Box and inventory reality

- Rebuilding ad structure around incrementality, not vanity ROAS

If your fees are rising but profit isn’t, the issue isn’t Amazon, it’s governance.

Ready to see where the margin is leaking?

Book Your Marketplace Profit Analysis →

FAQs – Amazon FBA Fees in 2026

What are the main Amazon FBA fees in 2026?

The main FBA fees include Fulfillment Fees (based on size/weight), Referral Fees (a % of the sale price), Monthly Storage Fees, and Aged Inventory Surcharges. Critical additions from 2025 that remain in effect are the Inbound Placement Service Fee and the Low Inventory Fee.

What replaced Amazon’s Small and Light program?

Amazon replaced the Small and Light program with Low-Price FBA Fees. This new structure automatically applies lower FBA rates to all products priced under $10, eliminating the need for enrollment but changing the cost dynamics for many sellers.

Does Amazon FBA increase fees every year?

Amazon does not increase fees across the board every year, but structural changes—like placement fees, inventory penalties, and low-price adjustments—continue to shift margin dynamics. Brands must model these changes annually at the SKU level.

How do I avoid low inventory fees?

To avoid low inventory fees, you must maintain more than four weeks (28 days) of inventory cover relative to your recent sales. The strategic sweet spot is holding four to six weeks of stock to avoid both low inventory penalties and aged inventory surcharges.

What’s the average fulfillment fee for standard-size items?

There’s no single average, but for a typical small standard-size item under 1 lb, expect a fulfillment fee in the $3.00 to $4.00 range. For a large standard-size item between 1-2 lbs, the fee is typically between $5.00 and $7.00.

How can I calculate Amazon profit?

Start with your retail price and subtract all per-unit costs: Referral Fee, Fulfillment Fee, Storage Fee, Inbound Placement Fee, a provision for Returns, and your Advertising Cost (TACoS). What’s left is your true, per-unit profit after advertising.

If you’re scaling revenue but margin keeps shrinking, your fee structure is misaligned with your growth strategy.

We’ll map your top ASINs, isolate non-incremental ad spend, quantify placement and storage impact, and show you exactly where profit is leaking.