If you’re running a 7-figure Amazon brand and your P&L looks healthy, but your bank account disagrees, this guide shows you exactly why—and how to fix it.

You’re scaling past seven figures. Sales look strong. NetSuite says you’re profitable.

But your bank balance tells a different story.

That gap isn’t an Amazon glitch. It’s a reconciliation failure caused by deferred transactions, and it quietly destroys cash flow visibility.

This isn’t bookkeeping noise. It’s a strategic cash risk that compounds with scale. For CFOs and operators, solving the Amazon deferred transactions & NetSuite reconciliation puzzle is critical for funding growth with real, not phantom, cash.

At-a-Glance: Amazon Deferred Transactions vs. NetSuite Reconciliation

Table of Contents

| Diagnostic Point | Why It Distorts NetSuite Reconciliation | Where Profit Visibility Breaks | At-Scale Risk (7-Figure Brands) |

|---|---|---|---|

| What They Represent | Funds withheld post-sale until delivery confirmation or claims periods clear. | Deferred transactions create a gap between when a sale is recorded and when cash is received. | Working capital gets trapped, creating a false sense of liquidity. |

| The Core Conflict | Amazon reports on a cash-based, 14-day settlement cycle; NetSuite requires accrual-based monthly accounting. | The two systems’ calendars are fundamentally misaligned, distorting monthly revenue and profit. | Inflated P&Ls drive poor capital allocation and flawed inventory forecasts. |

| Refunds & Claims | Deductions for returns and claims are often netted from future payouts, long after the original sale was booked. | Margins appear artificially high in one period, only to be corrected in the next, hiding true SKU profitability. | Chronic margin erosion goes undetected until it becomes a significant financial drain. |

| Delivery Date Reserves | Amazon’s policy (DD+7) creates a permanent, rolling hold on cash that grows with sales velocity. | The reserve isn’t a temporary hold but a constant drag on working capital, making cash flow unpredictable. | Aggressive growth stalls as cash needed for inventory and ad spend becomes perpetually stuck in transit. |

What Amazon Deferred Transactions Actually Represent

Amazon deferred transactions represent funds from a completed sale that Amazon holds before releasing them in a payout. This isn’t a penalty; it’s a standard operational delay tied to delivery confirmation, potential refunds, A-to-z claims, and invoiced orders for business buyers.

The key distinction for operators and finance leaders is timing versus recognition. The sale has occurred, and the revenue is technically earned. However, the cash is not yet available. Deferred does not mean unpaid—it means unrecognized in your financial system. This lag is the root cause of reconciliation failures between Amazon’s platform and your NetSuite ledger.

The Real Issue—Amazon Settlement Logic vs. NetSuite Accounting

The core of every Amazon deferred transactions & NetSuite reconciliation headache is a fundamental conflict: Amazon reports by settlement, while NetSuite demands reporting by accounting period. These two systems were never designed to align, creating a blind spot where true profit visibility disappears.

Why Amazon Settlements Don’t Map Cleanly to NetSuite

Amazon’s settlement reports are cash-based snapshots of a 14-day window. They show what cleared, not what was earned. NetSuite, governed by accrual accounting principles, requires revenue and expenses to be recognized when they are incurred.

Deferred transactions sit squarely between these two systems. They represent earned revenue that hasn’t cleared Amazon’s settlement process, creating a phantom asset that standard reconciliation workflows completely miss. This forces a disconnect between what operators see in Seller Central and what finance sees in the ledger.

Where Refunds, Claims, and Reserves Break Reconciliation

This timing mismatch becomes exponentially worse when factoring in the operational realities of a high-volume Amazon business. The reconciliation doesn’t just break on sales; it breaks on every transaction line item.

Refunds: A customer returns a product purchased in May, but the refund isn’t deducted from a settlement until June. NetSuite will show May’s margin as artificially high until that deduction hits.

Claims: A-to-z Guarantee claims are netted directly from a settlement total, often buried among thousands of other lines. Isolating these costs to the correct SKU and accounting period becomes nearly impossible without a granular process.

Delivery Date Reserve (DD+7): The infamous “DD+7” policy means Amazon holds your funds for a full week after confirmed delivery. For a growing brand, this becomes a permanent, rolling liability that ties up a significant portion of working capital.

The system creates a financial illusion. If refunds clear in Amazon but lag in NetSuite, margin reports inflate profit that never hits the bank. This can mask serious issues with product quality or listing accuracy, which you can learn more about in our guide to Amazon return recovery strategies that maximize your margin.

Delivery Date Reserves (Why Cash Feels ‘Stuck’)

For operators, the pain of deferred transactions is the constant feeling that cash is trapped just out of reach. This bottleneck is almost entirely driven by Amazon’s Delivery Date Reserve policy.

The “Delivery Date + 7” (DD+7) rule dictates that Amazon holds your funds for seven days after an order is delivered to cover potential customer issues. For a scaling brand, this isn’t a temporary hold; it’s a permanent, rolling drag on liquidity that makes reliable cash flow forecasting a nightmare.

This reserve scales against you. The faster you grow, the larger the permanent cash drag becomes. New product launches, Prime Day peaks, and successful PPC campaigns all spike sales volume, which in turn dramatically inflates the amount of cash held in reserve. The cash returns from your biggest wins are delayed, crippling your ability to reinvest in more inventory or ad spend at the moment you need it most.

Why This Problem Scales With You

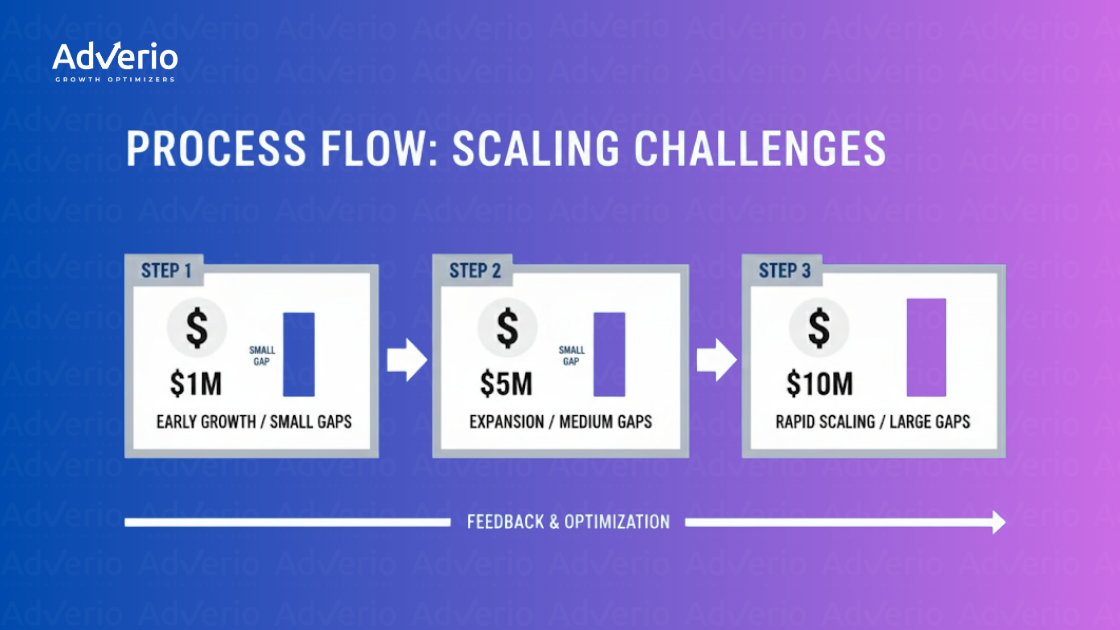

What starts as a minor bookkeeping annoyance at $1M in sales quickly snowballs into a critical business risk at $10M. The small, manageable gaps in your Amazon deferred transactions & NetSuite reconciliation don’t just grow—they multiply, leaving massive financial blind spots that cripple your ability to invest.

Volume Multiplies Blind Spots

Growth isn’t linear. Every new SKU, successful campaign, and market expansion adds another layer of potential failure points to your reconciliation process.

More SKUs create more complex deferral scenarios, with different shipping times, return rates, and customer issues that make a one-size-fits-all approach to reconciliation useless.

More refunds create wider and more unpredictable timing gaps between Amazon’s settlement and your NetSuite ledger.

More claims get buried deep inside settlement reports, making it a full-time job to isolate and attribute these costs correctly.

This is where manual processes break and understanding why manual processes often don’t scale becomes critical.

Why Aggregate Views Lie

Relying on top-line revenue in Seller Central is like trying to navigate a ship by staring at the sun. It tells you the general direction but offers zero insight into the dangerous currents below the surface.

Aggregate views don’t show that a best-selling product has a crippling return rate masked by other SKUs, or that a huge chunk of your cash is permanently tied up in a rolling delivery reserve. A deep dive into your SKU economics on Amazon can reveal how these hidden costs erode margins and expose which products are actually funding your growth.

Worse, they blur the line between revenue capture and revenue creation. If branded demand is doing the heavy lifting while deferred cash piles up, you’re not scaling—you’re recycling demand without true incrementality.

At scale, small reconciliation gaps turn into six-figure forecasting errors. This isn’t a bookkeeping problem—it’s a strategic crisis that impacts your ability to fund inventory, scale ad spend, and make confident growth decisions.

Scaling exposes financial weaknesses. If your NetSuite and Amazon settlement data don’t align cleanly, growth will amplify the distortion.

👉 Book Your ROI Forecast and see where cash is actually leaking.

What Clean Amazon ↔ NetSuite Reconciliation Actually Requires

A clean reconciliation framework requires a fundamental shift: you must stop the soul-crushing exercise of order-level matching and move to a strategic, settlement-level approach. The goal isn’t to match every order; it’s to build a system that accurately tracks money flowing through Amazon’s ecosystem and into your bank.

This means deconstructing Amazon settlement reports into their core financial components before they touch NetSuite. A proper reconciliation process requires separate tracking for:

Deferred revenue (cash in transit)

Released funds (cash moving out of the deferred bucket)

Refund timing (matching deductions back to the original sale’s period)

This isn’t accounting busywork. It’s financial governance. A clean reconciliation requires tight alignment between your ecommerce operations team, who understands the ‘why’ behind the numbers, and your finance team, who understands the ‘how’ of recording them. This is exactly why our Amazon Account Management services focus on financial governance before growth, because scaling chaos just makes the problem bigger.

How Adverio Fixes This (Before You Scale)

Most agencies pour fuel on traffic. We fix the financial engine first.

Through our Amazon Account Management framework, we:

Separate deferred revenue from earned revenue properly

Align settlement reporting with accrual accounting

Identify incrementality vs. phantom demand

Protect working capital before increasing ad spend

Because ads are traffic. They are not a financial strategy.

👉 Get My Profit ROI Forecast

FAQs

What are Amazon deferred transactions?

Amazon deferred transactions are funds from a completed sale that Amazon withholds temporarily before payout. This cash is typically held to cover delivery confirmation periods (DD+7), potential customer refunds and claims, or invoiced orders from business buyers. They represent earned revenue that is not yet available as cash.

Why don’t Amazon payouts match NetSuite revenue?

Amazon payouts don’t match NetSuite revenue because of a fundamental conflict in reporting methods. Amazon reports on a cash-based, 14-day settlement cycle, while NetSuite requires accrual-based accounting tied to calendar months. Deferred transactions, refunds, and claims create timing mismatches that distort the financial picture if not properly reconciled.

How long does Amazon hold deferred funds?

The hold time varies. For most standard orders, Amazon holds funds under its Delivery Date Reserve policy, which is typically seven days after confirmed delivery (DD+7). For invoiced orders from Amazon Business customers, the hold can be 30–45 days or longer, depending on the buyer’s payment terms.

Are deferred transactions an accounting or cash flow issue?

They are both, which is what makes them so dangerous. From an accounting perspective, they create a revenue recognition challenge that can skew P&L reports. From a cash flow perspective, they tie up working capital needed for inventory and ad spend, creating an operational bottleneck that stalls growth.

When should brands worry about delivery date reserves?

Brands should worry about the Delivery Date Reserve as soon as they scale beyond the point where manual tracking is feasible, typically around the 7-figure revenue mark. As sales volume increases from new product launches or peak seasons, the amount of cash held in this rolling reserve can explode, turning a minor annoyance into a significant strategic risk.

If your P&L looks healthy but your bank account says otherwise, it’s time to fix the system—not add more ad spend. Adverio translates messy Amazon data into financial truth, fixing visibility issues before you scale.