Table of Contents

Ever wonder what your Total Addressable Market (TAM) is?

Well, now we can answer these burning questions more objectively for you.

Amazon’s Search Query Performance (SQP) Report has been around for a while, and years later, everyone is finally starting to talk about it. The SQP is a pivotal tool for sellers aiming to enhance their marketing agenda, conquer market share, and boost sales.

Most of the initial buzz and complaints revolved around how to extract the data, and Amazon finally(!) listened by offering an export feature. Once the data was exportable, the next chatter shifted to what to do with it. That, is exactly what we’ll be showcasing in this article.

We’ll look into how the Amazon SQP report, along with tools like our QRY-IQ (pronounced: Query-Eye-Que) framework.. QRY-IQ will uncover both organic/paid initiatives. Also, helps to refine advanced search marketing strategies.

What is the Search Query Performance (SQP) Report?

The Search Query Performance dashboard was intended to show brand owners how shoppers and customers are searching for their brand as well as engaging with their competitors. It solely focuses on your catalog’s performance during the search results stages.

During the specified period, the dashboard displays various metrics associated with your products throughout the entire shopping process, including search displays, clicks, cart additions, and purchases.

It is important to note that the total number for purchases shown on this dashboard might differ from your sales report totals. As it only includes metrics derived from the search results page. This means the report excludes traffic from widgets like “Top Rated” or “New Arrivals,” focusing solely on direct search queries. Search Queries are included in your report based on the volume of ASIN impressions and clicks during the timeframe, and not all queries meet the criteria to be featured on this dashboard.

As such, the SQP Report is a cornerstone of Amazon’s suite of analytical tools aimed at sellers. Over the years, Amazon has continued to release tool after tool, with some being significantly better than others. IMHO, the SQP report is hands down one of the most beneficial to date, and I aim to prove it below.

Search Funnel Market Share and Key Metrics from the Amazon SQP Report

Below are the comprehensive and mostly exact definitions of metrics provided within the Search Query and Search Catalog Performance Dashboards. These are important in confirming how Amazon is calculating vital metrics as well as what they are including and excluding.

TL,DR: If you’re already familiar with these definitions that are unique to the Search Query Performance Reporting, feel free to skip down to the next section What questions can the SQP answer?

Search Query Score: This score sorts each search query based on performance from the best to the worst. Amazon currently discloses the top 1,000 ranked queries. This column cannot be removed or hidden.

The score is calculated using a combination of metrics from the search funnel—impressions, clicks, cart adds, and purchases—related to the queries and the performance of your brand. The queries are organized in the list by their rank, beginning with the highest ranked.

Search Query: The query entered by customers is presented as is in this column, which cannot be hidden. Amazon does not categorize these queries into topics; they are displayed exactly as typed by the customer.

They include search queries relevant to the selected brand. If, for instance, you were to introduce a new category like “coffee mugs” in the future, queries related to coffee mugs would then be included.

The types of queries covered range from those with “broad shopping intent” to more targeted or “specific shopping intent” queries.

Search Query Volume: The frequency at which this query was searched during the specified time period is recorded.

IMPORTANT: Every instance of a query made within a day is counted. If the same query is repeated by the same customer session multiple times within a 24-hour period, each occurrence is included in the total query volume. Additionally, clicking on a subsequent page of search results will increase the search volume count.

Price (Median): Median price across all of the ASINs for the query, at the time of impression.

The price excludes shipping and taxes.

Brand Price (Median): Median price across all of the Brand’s ASINs for the query, at the time of impression. The price excludes shipping and taxes.

Search Funnel – Impressions: The total number of impressions for all ASINs is calculated based on their appearance in the search results.

Whenever an ASIN is displayed in response to a query, it counts as one impression. This tally includes organic and sponsored products. Though, does not account for ASINs shown in widgets like “Editorial recommendations,” “Top rated,” or “Highly rated.”

The count also includes items displayed to customers regardless of their position in the searchable view. For instance, if your product appears at position 16 under the query “coffee pod” and is visible only after scrolling, it still registers as one impression.

This measure incorporates ASINs from pages that were actually viewed by the customer and excludes those from unviewed pages. For example, an ASIN that appears on the second page will be included if that page is viewed, but it will be excluded if it is meant to appear on a rarely clicked tenth page.

Additionally, impressions are counted from query refinements. If an ASIN appears first under the general query “coffee pod” and then again under a more specific query like “Medium roast” after the customer refines their search, each display counts as a separate impression.

Brand Count: The total number of impressions, clicks, cart-adds, or purchases for ASINs for the selected brand that originated from the search result.

The Brand Count is calculated at the brand level and includes all offers on a listing during the selected time frame.

Brand Share: Percentage share of impressions, clicks, cart-adds, or purchases from the brand’s catalog compared to the total count for the query. Brand Share is the Brand Count divided by Total Count.

ASIN Count: The total number of impressions, clicks, cart-adds, or purchases for the selected ASIN for this query.

ASIN Share: Percentage share of impressions, clicks, cart-adds, or purchases attributed to the ASIN compared to the total count for the query. The “ASIN Share” is the ASIN Count divided by Total Count.

Search Funnel – Clicks: The total number of ASIN clicks & views, recorded during the selected period. A click is considered valid when it leads to the rendering of the ASIN’s detail page directly from the search results.

This metric should be evaluated comprehensively, taking into account both the number of clicks and the impressions to gain a full understanding of its context.

Click-Through Rate (CTR): The CTR is a crucial metric that indicates the level of relevance and quality of your product based on the shoppers’ intended search. It is calculated by comparing the percentage of clicks to the number of impressions your ASINs received from search results.

CTR signifies how well your product engages potential customers. For instance, if your ASIN garnered 10,000 impressions and 400 clicks, this results in a CTR of 4%.

It’s important to note that there is no universal benchmark for ‘good’ CTR, as it can differ based on factors such as product category, the device used for browsing (such as mobile versus desktop), and the specifics of the search query as well as a host of other variables.

On that topic, you can check out our Main Image Optimization and Listing Copywriting services that can help increase your CTR and make your ads more efficient.

Search Funnel – Cart Adds: The complete count of ASIN additions to shopping carts, recorded within the selected timeframe, comes from the search results page. While customers may add items to their carts from various pages such as the product details page, we allocate these additions to the ASIN displayed in the search results.

It is important to note that there are additional ways customers can add products to their carts, such as being redirected from external websites to the product’s detail page. However, these cart additions are not included in Amazon’s count since they do not originate directly from search activities.

Search Funnel – Purchases: The total number of ASIN purchases during the selected timeframe originated exclusively from the search results page. This metric reflects customers’ willingness to finalize their purchase after adding your product to their cart. It counts only completed purchases and does not exclude transactions that are later canceled or returned.

There may be discrepancies between this purchase count and the overall sales figures reported in your sales data. This figure exclusively counts purchases that are linked to the search funnel starting from the search results page, and it does not account for sales originating from other areas such as “Top Rated” widgets, the homepage, or the product details page.

Furthermore, this metric captures purchases that occur within a single day. For instance, from the point of query initiation encompassing all funnel activities like impressions, clicks, cart adds, and final purchases, all actions must occur within a 24-hour period (i.e., the attribution time period is 24 hours). Transactions where a customer queries and adds to cart one day but completes the purchase the next are not included. We plan to refine this attribution approach in subsequent updates.

Conversion Rate: The conversion rate measures the rate at which customers progress from clicking on a product to purchasing it. This metric calculates the ratio of purchases to clicks for ASINs originating from the search results page.

The attribution of a purchase relies on the last point of product discovery. If the last discovery before purchase occurs through search results, then that purchase is counted. However, purchases made from direct visits to the product’s detail page via external websites are not included in this metric.

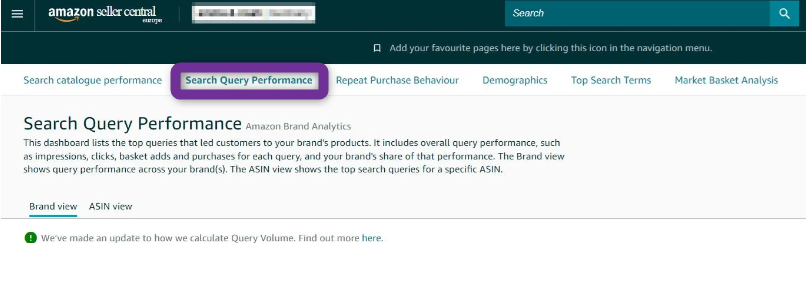

How do I find my Amazon Search Query Performance Dashboard?

Simply navigate to the Amazon Search Query Performance dashboard by visiting Seller Central → Brands → Brand Analytics → Search Query Performance or easily follow this link (you must be logged in to access): https://sellercentral.amazon.com/brand-analytics/dashboard/query-performance

Keep in mind that the Search Query Performance dashboard is only made available to brand-registered sellers. This due to it be apart of the Brand Analytics suite, which only registered brands have access to.

To access the Search Query Performance dashboard, you either need to be your brand’s primary Seller Central account administrator or allowed access to Brand Analytics.

Exploring the Data from Amazon’s Search Query Performance Dashboard

With an understanding of what the Amazon Search Query Performance dashboard offers, let’s get into methods for extracting and refining the data provided in the report.

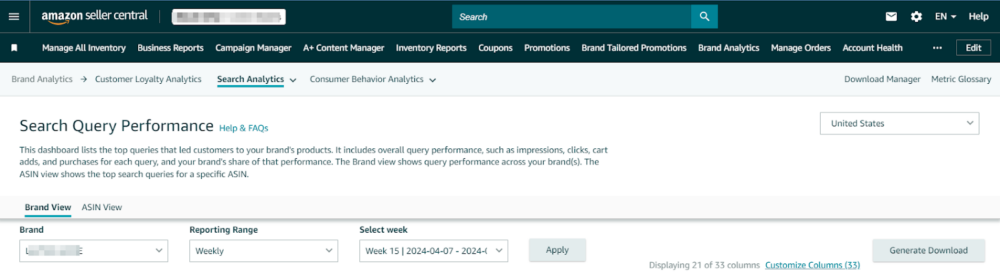

How to download data from the Search Query Performance dashboard

In the brand view, you can choose the time period (weekly, monthly, quarterly) and top 1,000 queries within the dashboard. The ASIN view will show the top 100 queries. I recommend showing and including all 33 columns.

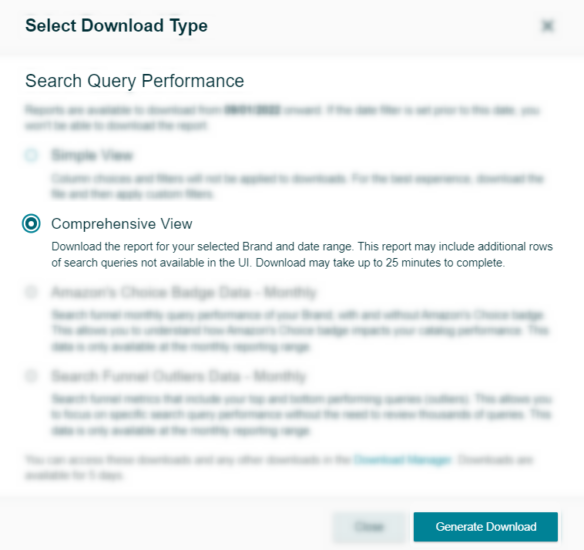

As of April 2024, you can click the “Generate Download” button to extract your SQP data.

Pro-Tip: How to 3.5x the queries. If you download the brand’s comprehensive report, you can get up to the top 3,500 ranked queries depending on the reporting range you select.

Transforming the Data (without QRY-IQ)

- Open the Data File: Open the downloaded file using a spreadsheet program like Microsoft Excel or Google Sheets.

- Organize the Data: Depending on your specific needs, you might want to reorganize the columns or filter out irrelevant data.

- Create a Pivot Table: Pivot tables are extremely useful for summarizing large data sets. They help you analyze specific aspects, such as the number of impressions, clicks, purchases, etc., across different search queries.

- Add Calculations: Insert calculated fields if needed to assess metrics such as click-through rates (CTR) or conversion rates from impressions to purchases. Amazon doesn’t provide these for you but with a few formulas, you can double the quantity of insights.

Utilizing Adverio’s QRY-IQ for Enhanced Insights

The Adverio Brand QRY-IQ report complements the SQP by providing a holistic view of a brand’s performance across 1000s of search queries. QRY-IQ amplifies Amazon’s data to present a more granular analysis and extrapolates hidden insights.

It provides brands with the intelligence needed to thrive on the competitive stage of Amazon. By understanding detailed metrics and applying them judiciously, sellers can significantly improve their visibility, customer engagement, and, ultimately, sales performance.

Here are a few categories of various additional insights surfaced by QRY-IQ:

– Priority Level Insights: Ranging from accessible ad victories to elite ad breakthroughs to significant enhancements to your PDPs’ CTR and CVR, QRY-IQ identifies strategic points where even the most minimal adjustments can lead to significant revenue bumps.

– Buyer Funnel Metrics: Tracks shopper engagement from initial search to purchase, offering insights into where along the funnel customers might be dropping off or converting, and most importantly, relative to the top 10 ASINs for each search query.

– Pricing Analysis: This section helps to measure price elasticity and segments the market by pricing relative to your product prices.

– Search Market Share: Understand your current market share and track it over time while comparing that against the average of your peers. This only includes your search market and doesn’t include orders placed that originated from outside of the search results pages or various widgets, as mentioned above.

– Branded vs UnBranded Share of Search: With a few creative filters, you can weigh where your top search traffic originates from, whether that be brand-agnostic shoppers or those searching for you specifically by name.

Keep in mind that these are only a handful of general insights. Now, let’s delve deeper into many more use cases and vital questions that can be answered.

What questions can the SQP answer?

The possibilities are endless if you’re willing to put your thinking cap on. It can help you find answers to profit-boosting-money-saving questions such as:

- How is my pricing relative to the top 10 ASINs for a given search query? We can go even deeper by aggregating search queries to get a market average price comparison.

- Which search terms are objectively the best performers for my brand v.s. the Top 10 ASINs for that search query? Do you mean that I can find out exactly which search terms I have a higher click-through rate, add-to-cart rate, and purchase rate vs. the top 10 competitors? Oh yeah(!) and way more where that came from.

- What is my search market share for KPIs such as search volume, impressions, clicks, add-to-carts, and purchases? We’ll even show you how we track this over time to help surface product vs. market directionality.

- Now that I know my market share, how can I increase it? By how much?

- How can I assess the effects of alterations in my business tactics?

- Should I update my main photo? If so, what else should I, or should I not, include in it?

- How can I capitalize on missed opportunities during this same period last year? It’s one of my favorites!

- The list goes on and on…

Unlimited Use Cases of Amazon’s Search Query Performance Data

Tired of reading? Skip through the deep dive and download our QRY-IQ tool here

-

Amazon SEO—Optimize Listings and Amazon Storefront:

Using insights from the SQP report, enhance your product titles, images, and descriptions to align closely with high-performing and high-potential search queries.

In addition to adding search terms (using exact match) to your listing’s copy, you’ll want to find ways to speak directly to those within your main image and gallery images.

One of the quickest ways to improve your CTR is to have your main image clearly depict the most searched and converted shopper queries. Can you include additional text on your product that is currently a blank space? Do you include your packaging and does that packaging have easy to read text that is exactly what the customers are searching for? It could be as simple as adding the quantity, size, or main keyword and use cases.

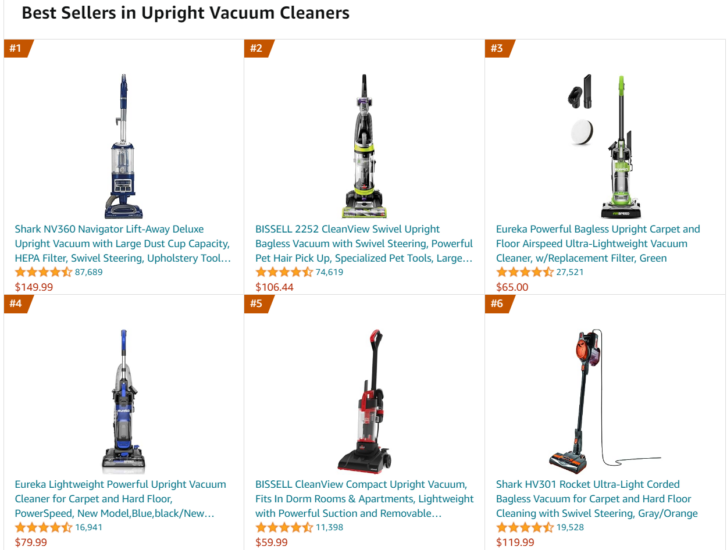

Take a look at the top-selling Upright Vacuum cleaners. They all look nearly the same, and none of them speak to specific features or benefits.

-

Adjust Advertising Strategies and Track Impact:

This is one of, if not, the quickest optimization levers you can pull to increase your RoAS and market share instantly

Firstly, you must stop going after vanity search terms solely based on current rank vs. desired rank. Instead, prioritize ad spend towards queries with lower impression share and higher click share, CTR, and CVR compared to the category. These are the terms where you have already proven to outperform the competition and can more easily climb the ranks.

On the flip side, tweak campaigns based on query performance data by phasing out underperforming ones. These are terms where you may have higher impression and click share but shoppers fall off before adding to cart and purchasing. For those, you’ll need to further assess how to increase your CVR, and, per #7 below, the SQP can help you determine if it’s possibly due to price elasticity or lack thereof.

-

Product Ideas – Innovate Based on Buyer Behavior:

Leverage buyer funnel metrics to innovate product offerings or adjust existing ones to better meet the needs and expectations of your target market. You can also use SQP data to spot trends that may represent new product lines or product line expansions.

You can further fuel your Product Research and Development efforts by diving into Amazon’s Product Opportunity Explorer and Market Basket Analysis. This can help you find gaps in the market where few or no products are available. It can also surface popular in-demand products that are ripe for the taking. Similarly, when looking at search queries over time, you can start to spot changes in consumer behavior that will help you determine where to pivot next.

-

Surfacing New and Neglected Search Terms:

We routinely find search queries during brand reviews that are sub optimally optimized. Meaning, either not investing profitable search terms or not promoting them enough.

Carefully examining the search terms in Amazon’s Search Query report can provide valuable insights for identifying potential keywords to further enhance your Amazon SEO and PPC advertising efforts.

It’s advisable to align the pertinent terms from the Search Query Performance report with the keywords already being targeted in your existing PPC campaigns.

Identify any related search terms that you might have overlooked. Prioritize those with a substantial number of orders, as these are crucial for expanding your market presence. Implement these terms in your PPC strategies, structuring your campaigns around the overall market demand. Use these insights to set up new ad groups and additional campaign types within your Amazon advertising account. Take it a step further by refining your ad copy, storefront landing pages, and product detail pages (PDPs) to incorporate these new keywords more effectively.

Once you have initiated campaigns with these new keywords, continually track your performance metrics, such as click-through rates, conversion rates, and Advertising Cost of Sales (ACoS), to evaluate whether these keywords are positively impacting your results.

The next use case will dive into exactly how to measure and track your effectiveness.

-

Split Testing – Deals, Pricing, Advertising, and Listing Opportunities:

It is not enough to simply make changes with a set-it-and-forget mentality. You have to create a system that objectively captures when and which optimizations made, then schedule intervals to revisit and track any deltas.

Since this is such a big topic that spans far more than just SQP, I created another guide that delves deep into the art of split testing and the #1 thing to keep in mind – Do NOT change more than 1 variable at a time. In this case, that doesn’t necessarily mean you can only increase or decrease the advertising spend on one query. Instead, that means you can’t push the same term for ad spend that you added to the listing copy or primary image. You have to keep your SEO and PPC optimizations siloed because correlation isn’t always causation.]

-

Amplifying Holiday, Seasonal, and Tentpole Sales Events (Prime Day 2024):

Optimizing your product’s ranking ahead of peak periods is crucial for maximizing visibility and sales. A compelling approach to achieve this is by utilizing data from the Search Query Performance report to pinpoint keywords that have historically driven sales.

One of our favorite, and most successful, tactics is to look at the prior year’s SQP. Take, for instance, the weeks and months leading up to Saint Patrick’s Day, if you have a brand or product that caters to this holiday. You can analyze data from the previous year’s same time period to identify effective keywords that you were out-converting the competition but had relatively lower impression share and click share. Focusing your PPC campaigns and optimizing your listings with these keywords can significantly enhance your product’s visibility and elevate organic sales leading into the peak season.

Due to reduced competition for these keywords before the peak times, enhancing your rankings on search results becomes more feasible. Seizing this advantage can significantly boost your organic and paid sales thus overall product visibility.

For example, we had an ASIN that sold around 50 units during the March 2023 event. When we dug deeper into the data and applied those tactics during February 2024, that same ASIN sold nearly 600 units over the same time period. That’s a 12x lift from very little effort.

- Anti-Cannablization / Anti-Mirroring Tactics: To gauge how dependent your products are on advertising, consider reducing your advertising expenditure on select search queries, such as your top-of-search ads, and observe the effect on your applicable purchase share. Remember, don’t do this across too many queries at the same time, or you may tank your listing’s sales velocity.

If you notice a significant drop in your sales share, it indicates that your Sponsored Products ads were substantially contributing to your sales. Conversely, if there’s no change in the sales share, it could mean that your sponsored ads were simply taking sales that your organic listings might have achieved without additional cost. This pattern in the data might imply that investing in Sponsored Products ads for that particular keyword isn’t necessary.

It’s best to conduct this experiment with a single keyword at a time rather than applying it across multiple keywords simultaneously. This method allows you to assess the impact more clearly and make informed decisions based on individual keyword performance. Particularly if your products already rank well organically. A test can reveal whether your organic sales are robust enough to lessen your reliance on paid advertising.

It’s also important to note that focusing solely on click share might not yield useful insights in this scenario. Reducing ad spend will decrease the visibility of your product in Amazon’s search results, leading to fewer clicks.

- Measure Incrementality – Performance by Query Type: Distinguish between branded and non-branded query performance to tailor your SEO and advertising strategies accordingly. This is a sure fire way to gauge your level of incrementality.

Want to read more about how to measure and improve your incrementality? Check out this deep dive: How We Exponentially Increase Your Incrementality: No AMC or Algorithms Required

We often audit brands that chase favorable RoAS and ACoS and struggle to accept the reality that they are actually paying for conversions that they would likely not have otherwise had to pay for—all to artificially boost their ROAS. The worst is when another agency is the behind the effort, they should know better.

Instead, if they deploy the above #7 tactic they would quickly realize there money would be better spent going after brand agnostic search queries or even trying to conquest competitor brand searches especially when their brand has better pricing, reviews, and can easily steal market share

That leads to my final point below on how to out maneuver the competition and have them start chasing you!

- Start Increasing Your Market Share – Today! If you successfully apply and measure even just one of the above tactics, you should be able to start chipping away at the market. If you apply just a few then you will start to see the competitor in your rear-view mirror.

Please(!) don’t allow the list to end here as there are so many ways to slice and dice the data as it relates to your brands’ needs and goals. If you have any other use cases that you want to test or already know work well, then please drop me a line marketing+sqp@adverio.io

Challenges and Advanced Considerations

While leveraging the SQP report and QRY-IQ framework, brands must also be aware of:

– Market Dynamics: Continually changing consumer preferences and competitor strategies can affect the performance of specific queries.

– Data Overload: Properly parsing through extensive data to find actionable insights requires skill and sometimes the assistance of analytics experts and tools. Don’t be afraid to ask for help.