Business Intelligence

BI that shows where your next dollar wins.

Adverio Business Intelligence connects ads, listings, pricing, inventory, and reviews into a single profit lens—so you scale what works, stop what doesn’t, and take back ground from competitors.

Every week you wait, someone else widens the gap.

Profit over vanity.

We model incrementality, not just clicks and ROAS.

Decisions in minutes.

Clear Do / Don’t callouts by SKU, query, and channel.

Playbooks attached.

Every chart links to an action you can deploy today.

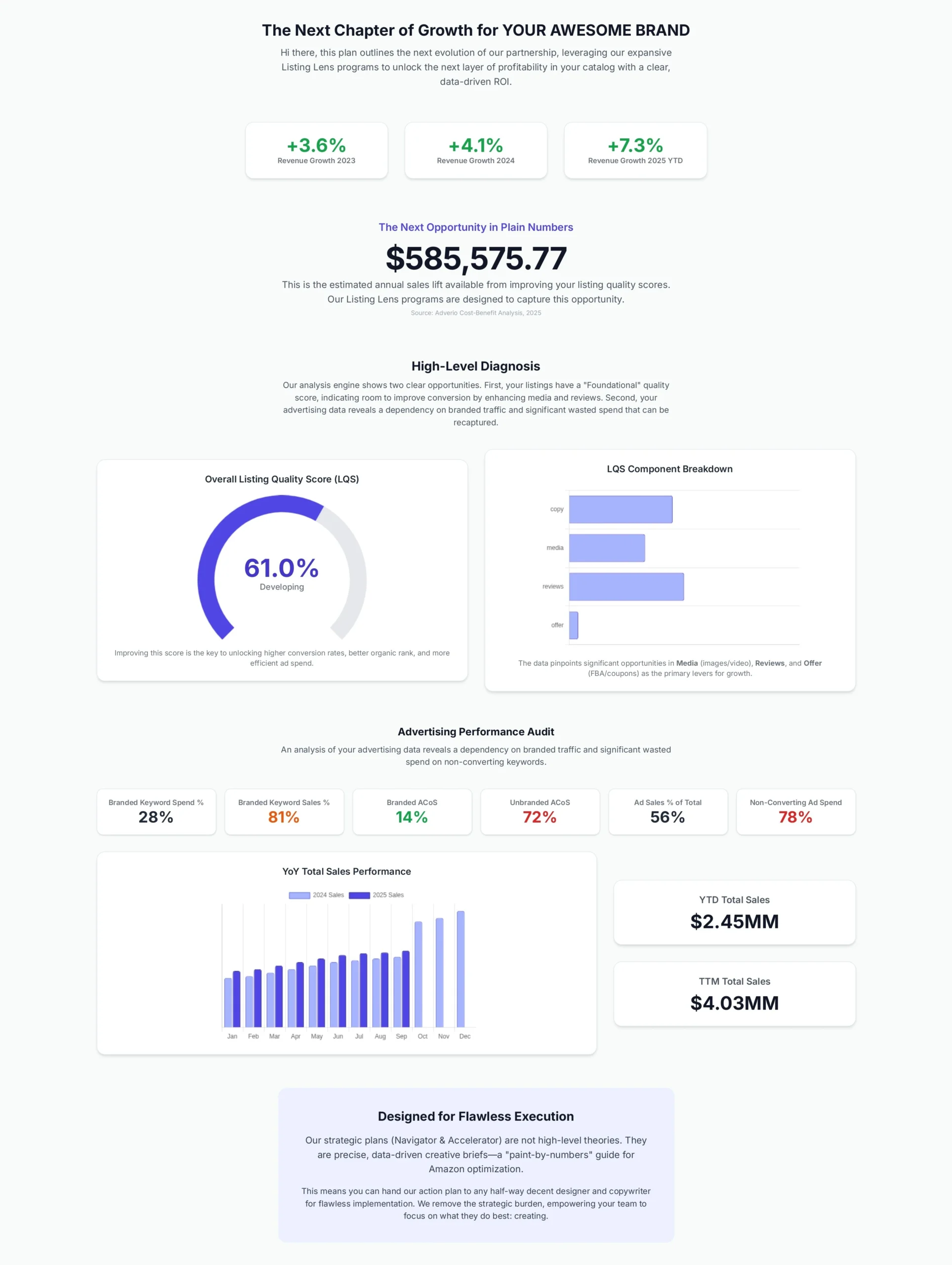

Core Profit Lenses

Incrementality Lens

Separates net-new sales from sales you’d win anyway.

ROAS can look great while you burn margin on branded defense.

Reallocate protected spend into generics that expand reach without spiking TACoS.

GEAR (Growth Efficiency & Advertising Ratio)

One composite KPI that ranks where your next dollar is accretive to margin.

Finds profit, not just revenue.

Route budget to SKUs/queries with positive GEAR delta.

Query IQ

Organic rank + impression share by query class (branded/generic/competitor).

Know when to push “king quilt,” when to hold.

Only spend where PDP readiness and rank velocity justify it.

CRO:SEO Scorecards

Five dials—Quality, Copy, Media, Offer, Reviews—with status tags and next actions.

“Only spend behind SKUs that convert.”

Fix the top 3 blockers per PDP; then scale ads.

Buy Box Stability + Price→CVR

Daily Buy Box %, promo risk flags, and price-elasticity vs conversion.

Don’t promote margin-negative SKUs or fight a volatile box.

Pause promos where price elasticity breaks CVR; anchor spend to stable box.

Profit Pulse System (PPS)

Live P&L by collection/SKU blending ad cost, fees, returns, freight.

Gives CFO-grade clarity to operators.

Kill or fix profit-leaking SKUs before scaling.

How It Works

Instrument

Connect ad, retail, catalog, and review data.

Interpret

We normalize, score, and surface Do / Don’t plays with guardrails.

Implement

We launch tests and track lift against Incrementality and GEAR.

Either way, you win: keep your team, or let us execute. We’re built for both.

From Insight to Action: A Real Play

Signal:

Branded spend = 62%; generic rank is sliding.

Action:

Reallocate 20% to top-5 generic terms where CRO:SEO ≥ 8 and Buy Box is stable.

Guardrails:

Pause if TACoS > +2 pts or CVR < –10%.

Watch:

Incremental sales, rank movement, and GEAR lift in 21–30 days.

Flexible Engagement Options

BI Essentials

Dashboards + monthly playbook review.

BI + Execution

We implement ads & CRO changes, iterate weekly, report lift.

Mini Case Snapshots

Omnichannel Home Brand (AMZ + WMT)

Problem: 70% ad spend on branded defense; generic share slipping.

Move: Shifted 25% to high-intent generics; CRO:SEO fixes on 12 PDPs.

Observed: ~20% topline lift in 60 days with improved TACoS (incrementality up).

Pet CPG (DTC + AMZ)

Problem: “SNS growth” masking churn.

Move: SnSR cohorts + first-order CAC cap + tailored promos.

Observed: Higher retained SNS mix; better margin per order.

Mini Case Snapshots

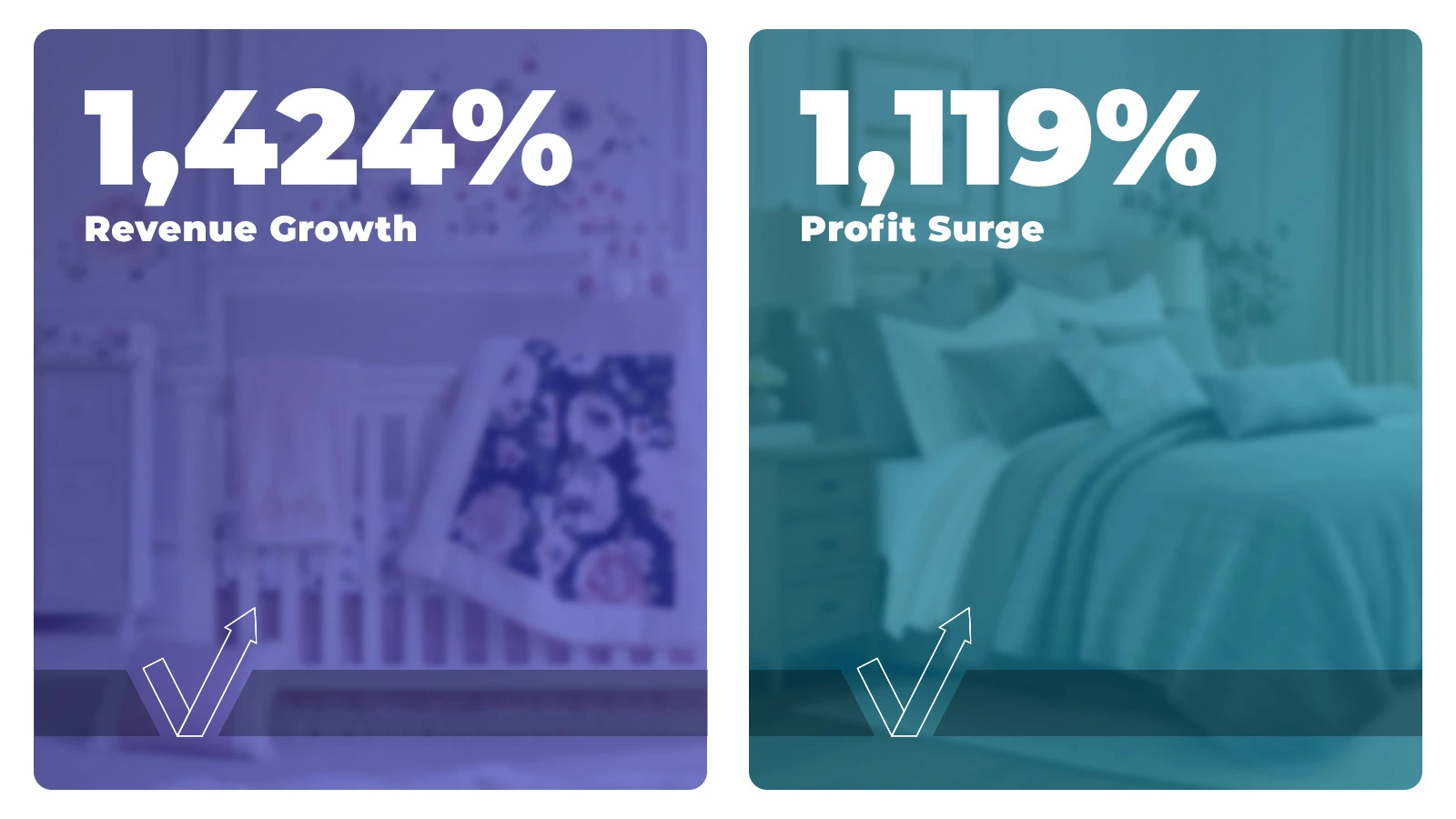

+1,424% Revenue Growth and +1,119% Profit Surge in 51 Months

Product Category: Softlines > Home & Kitchen > Bedding

Explore Case Study

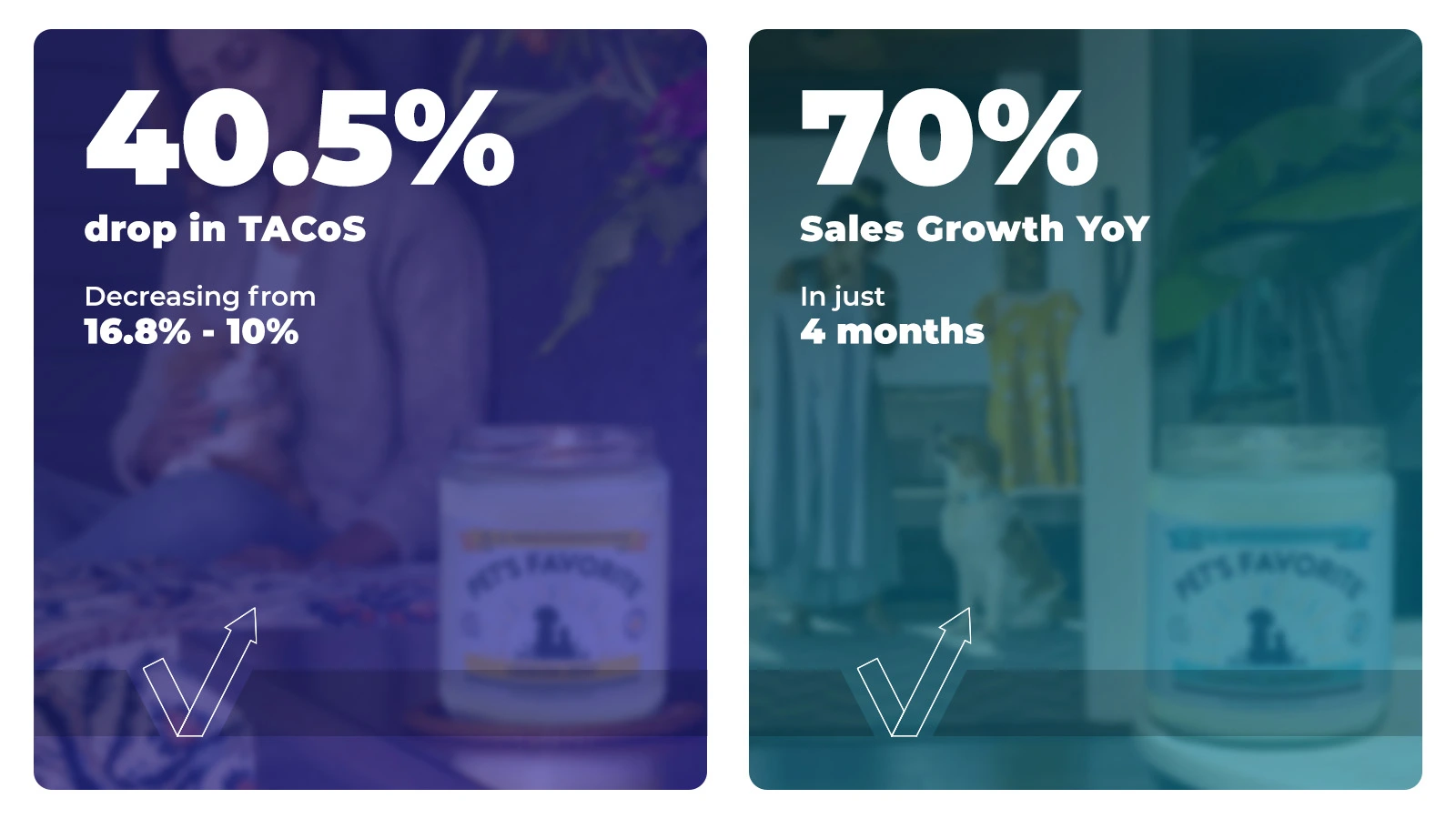

Profitability With 70% Sales Growth YoY — TACoS Dropped to 10% From 16.8%

Product Category: Home & Kitchen > Pet Supplies

Explore Case Study

325% Revenue Growth With Full-Catalog Acceleration in Just 6 Months

Product Category: Softlines > Clothing, Shoes, & Jewelry > Licensed Fan Apparel

Explore Case StudyFAQs

How is this different from “dashboards”?

Dashboards tell you what happened. Adverio BI tells you what to do next—and what not to do—backed by guardrails (Incrementality + GEAR).

We already have Looker/Power BI. Why you?

Great—keep them. We plug into your stack and add the operator logic: lenses, playbooks, and tests tied to profit, not just pretty charts.

What access do you need?

Ads + retail data (read‑only). We can run as advisory (your team executes) or execution (we do the work).

How fast do we see signal?

Budget reallocations and high‑impact PDP fixes typically show movement in 14–30 days; complex pricing/seasonality tests can take a full cycle.

Can you work across Amazon, Walmart, Target?

Yes. We’re built for multi‑marketplace catalogs—no silos, no channel whiplash.

Pricing?

Flat rate or aligned rev‑share. Either way we stay ROI‑first. You’ll know the math before a dollar moves.