Profit To Purpose

Everyone Deserves Access

We’re a profit-growth agency. Profit should enable opportunity - so we reinvest a portion of ours through Kiva, providing access to capital for founders who can’t get it through traditional means.

Adverio's Why

We loan because talent is everywhere; access isn’t.

Kiva crowdsources 0%-interest microloans to entrepreneurs who need a “first yes” to change their trajectory. Small loans. Big ripple effects.

We loan because every entrepreneur who solves real problems deserves capital — no matter their zip code, credit score, or passport. Talent is everywhere; access isn’t.

How It Works

We fund.

Each month, Adverio allocates a portion of profit to our Kiva lending pool based on the number of Brands we meet with.

They build.

Entrepreneurs use the loan to stock inventory, buy equipment, or expand services.

It revolves.

Loans get repaid; we relend. Impact compounds.

Kiva loans are repaid ~monthly; funds are recycled into new opportunities.

Our Commitments

-

Dollar commitment: We commit $25/brand/month to Kiva lending.

-

Match: Team & Partner Circle contributions are matched 1:1.

-

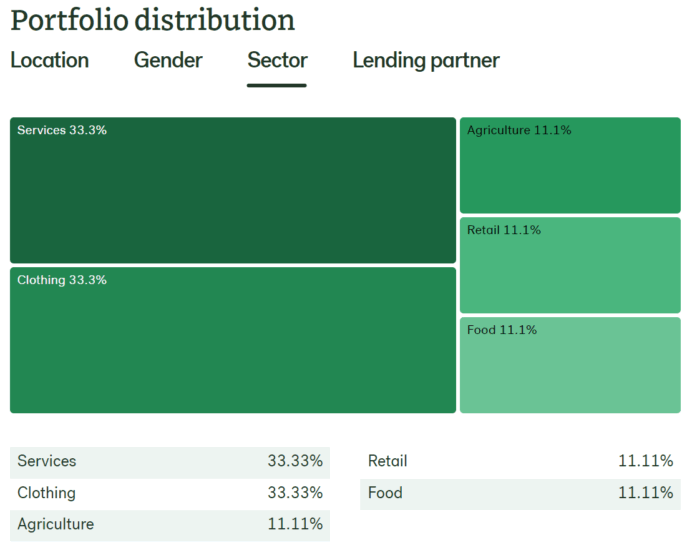

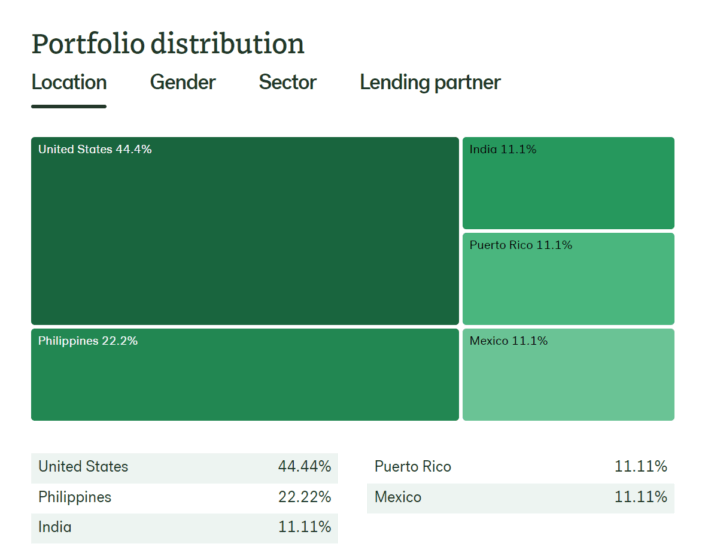

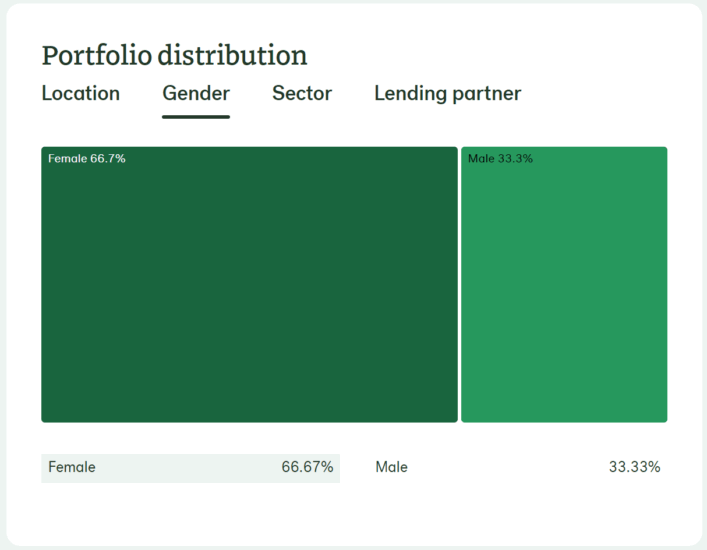

Transparency: Results posted below, updated quarterly.

Updated quarterly. Numbers represent cumulative lending through Adverio + our Partner Circle team (more here).

Repayment rate

Faces of the Impact

Lend With Us

Join the Adverio Impact Fund on Kiva and choose a borrower that speaks to you.

Everyone Deserves Access

Is this a donation or a loan?

An additional 10% of the funds are donated to Kiva. The funds are loans that can be re-lended as they’re repaid. There’s risk; repayment isn’t guaranteed, but Kiva’s historic repayment rate is high.

Do you profit from this?

No. Kiva loans are 0% interest to borrowers. Our return is impact.

Can I get a tax credit?

Kiva loans aren’t tax-deductible; optional donations to Kiva’s operations typically are (ask your tax advisor). We give an additional 10% to Kiva as a donation.

How much does Adverio contribute?

We start at $25/brand/month and increase with growth and 1:1 matched contributions.